Understanding COGS can help you better understand your business’s financial health. The LIFO method assumes higher-cost items (items made last) sell first. Thus, the business’s cost of goods sold will be higher because the products cost more to make. For each of the above accounting methods, a certain amount of accounting acumen helps when gathering the information for your income statement. FreshBooks offers COGS tracking as part of its suite of accounting features. It can help you track and categorise your expenses more accurately.

Net Accounts Receivable

Items made last cost more than the first items made, because inflation causes prices to increase over time. The LIFO method assumes higher cost items (items made last) sell first. Thus, the business’s cost of goods sold calculation will be higher because the products cost how to record cost of goods sold journal entry more to make. LIFO also assumes a lower profit margin on sold items and a lower net income for inventory. Additionally, in the calculation of the cost of the goods sold, the beginning inventory is the balance of the inventory in the previous period of accounting.

- When inventory falls to a certain level, the EOQ formula, if applied to business processes, triggers the need to place an order for more units.

- LIFO also assumes a lower profit margin on sold items and a lower net income for inventory.

- Additionally, in the calculation of the cost of the goods sold, the beginning inventory is the balance of the inventory in the previous period of accounting.

- Let’s say the business purchases $5,000 worth of products on credit.

- This will be reflected on their income statement, and the $8,000 of remaining inventory will be carried over to the next fiscal year’s beginning inventory.

Example of cost of goods sold under perpetual inventory system

Generally speaking, only the labour costs directly involved in the manufacture of the product are included. In most cases, administrative expenses and marketing costs are not included, though they are an important aspect of the business and sales because they are indirect costs. From the above examples of cost of goods sold general journal entry we can clearly understand the method followed to record entries in the books related to COGS. It shows how we can identify the required items from financial statement and use them to record for the COGS so that it becomes easy to use it for analysis and evaluation later on.

Is cost of good sold debit or credit?

Think about factory machinery that shapes raw materials into finished products. These items are constant players in production lines, turning steel into car parts or plastic pellets into toys. A company’s financial health and profitability hinge on its ability to manage COGS. Low COGS can mean higher gross profit, leaving more money for operating expenses and potential savings. Now that we’ve covered what COGS is, let’s delve into why it’s vital to record it in journal entries. Accurate COGS recording helps determine a company’s true gross profit.

These expenses are, therefore, also debited to inventory account under this system. The general examples of such expenses include freight-in and insurances expense etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost of goods sold account by debiting cost of goods sold and crediting inventory account.

Journal example of how to record the cost of goods sold

Instead, these are the charges you pay when you receive goods from suppliers. It helps businesses forecast demand and control purchases better. This careful balancing act ensures they don’t spend too much or too little on inventory, which could affect net income down the line. After calculating COGS, the next step involves managing your accounts through debiting and crediting inventory to reflect these changes accurately.

Then, you would make a corresponding credit to Inventory to reduce inventory value. An item damaged after it’s sold means a debit to COGS to increase COGS and a credit to Inventory to reduce inventory value. Adjustments to the costs of good sold journal entry for inventory include returns, damaged goods, and unsellable inventory. You need to ensure the accuracy of each costs of good sold journal entry if you want to be profitable. COGS is a major business expense, and errors in this area can really throw your numbers off. Both merchandising and manufacturing companies can benefit from perpetual inventory system.

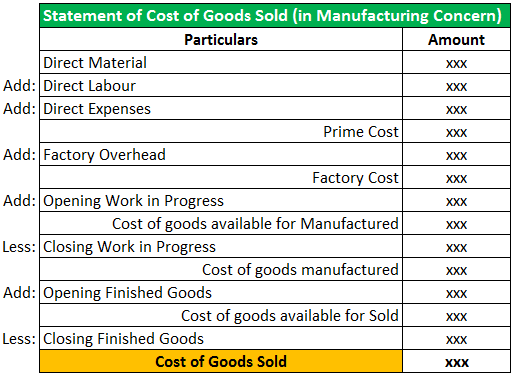

Therefore, a business needs to determine the value of its inventory at the beginning and end of every tax year. Its end-of-year value is subtracted from its start-of-year value to find the COGS. After labor costs, it’s important also to consider how shipping affects your bottom line. Keeping these entries straight ensures solid asset management and helps with future inventory valuation.

Typically, calculating COGS helps you determine how much you owe in taxes at the end of the reporting period—usually 12 months. By subtracting the annual cost of goods sold from your annual revenue, you can determine your annual profits. COGS can also help you determine the value of your inventory for calculating business assets. FIFO and specific identification track a single item from start to finish. Keeping track of COGS is key for any business to know its profits.