Blogs

Effortless immediate access to your accounts as a result of on line banking, the fresh RBC Mobile App and you can thru cell phone when, anywhere. You should use Schedule LEP (Form 1040), Obtain Improvement in Words Taste, to state a preference for notices, characters, or any other created communication from the Internal revenue service within the an option code. You might not instantly discover written communication from the requested code. The newest Internal revenue service’s dedication to LEP taxpayers belongs to a good multiple-year timeline one to first started delivering translations inside the 2023. You’ll still found communications, as well as sees and emails, inside the English until he or she is translated on the common language. To the Internal revenue service.gov, you should buy up-to-time information on latest situations and you can changes in income tax law..

Enter which code should you have excused earnings under the government Army Partners Residence Recovery Act (Personal Law ). For additional information, come across TSB-M-10(1)We, Armed forces Spouses Residence Save Operate, and you may TSB-M-19(3)I, online bingo sites Veterans Advantages and you may Change Act out of 2018. User-friendly e-file software guarantees you file all of the correct versions and you may perform maybe not overlook valuable credit. Which hook takes you to help you an external webpages otherwise software, which may have other privacy and you will defense formula than U.S.

Income tax to your Efficiently Linked Earnings

Backup Withholding – Having certain restricted conditions, payers that are needed to keep back and you will remit copy withholding so you can the new Internal revenue service are necessary to keep back and you will remit to the FTB to the income acquired to help you California. In case your payee has duplicate withholding, the newest payee must get in touch with the brand new FTB to provide a valid taxpayer identity matter, ahead of processing the fresh tax go back. Inability to provide a valid taxpayer identification count can result in an assertion of your backup withholding borrowing from the bank. To learn more, go to ftb.ca.gov and search to possess backup withholding.

But eliminating shelter dumps is not necessarily the address—protection places remain ways to cover your house that assist owners hold onto their funds. Listed below are nine effortless a way to raise protection put transparency, help the citizen sense, and you may secure finest shelter put ratings. Provided now’s consumer trend to your much more software-based percentage vehicle and you may digitally addressed dollars total, tenants are looking for modernized processes for defense put payment and you will refunds. We have found a summary of Washington leasing direction applications to own tenants experience difficulty. Here is a summary of Virginia leasing guidance programs to possess clients feeling hardship. The following is a list of New york local rental direction applications to have renters sense difficulty.

The new Baselane Charge Debit Card is awarded because of the Thread Lender, Representative FDIC, pursuant in order to a licenses out of Charge You.S.An excellent. Inc. and may also be taken anywhere Visa notes is actually approved. FDIC insurance is available for cash on put thanks to Thread Bank, Representative FDIC. Running borrowing from the bank and you can background records searches are very important to reduce the chance out of non-commission. But not, either requiring a great cosigner to a rent is needed to publicity… A renter is even likely to avoid breaking the assets when they learn the procedures know if it found its full defense deposit back. Important information usually becomes tucked in the “fine print” so we’ve selected particular “reasonably-sized print” as an alternative.

Make sure to file how just in case your shared their mailing target along with your earlier property manager. Issuance out of Jetty Put and you may Jetty Manage tenants insurance is at the mercy of underwriting opinion and you can acceptance. Excite find a copy of your policy for a complete conditions, standards and exceptions. Publicity scenarios is hypothetical and you may shown to have illustrative intentions merely. Publicity is founded on the true issues and you will things providing go up to a claim.

Projected Taxation Setting 1040-Parece (NR)

Spending electronically is fast, simple, and quicker than simply emailing inside a check otherwise money buy. The newest cruising otherwise deviation permit isolated from Form 2063 will be used in the departures inside newest season. But not, the brand new Internal revenue service will get terminate the brand new cruising otherwise departure permit for the afterwards departure when it believes the new type of taxation is actually jeopardized because of the you to definitely later departure. If you don’t belong to among the groups noted before below Aliens Not necessary To get Sailing otherwise Deviation Permits, you should see a cruising otherwise deviation allow.

Latino Area Credit Partnership

The fresh monthly speed of one’s incapacity-to-spend penalty is actually half plain old speed, 1/4% (0.0025 as opposed to ½% (0.005)), if a payment agreement is in impact for the few days. You really need to have filed your own get back by the deadline (in addition to extensions) in order to be eligible for which shorter punishment. Utilize the Public Security Pros Worksheet from the Tips to have Setting 1040 to help you figure the new taxable section of the personal security and you may equivalent tier step 1 railway retirement benefits for the region of the season you were a citizen alien. Whenever deciding what income is actually taxed in america, you should think exemptions below You.S. taxation law plus the smaller income tax cost and exemptions provided by taxation treaties between your United states and you may specific overseas places. When you’re a bona-fide resident from Puerto Rico for the entire year, you might prohibit out of revenues all of the earnings out of provide inside Puerto Rico (aside from amounts to have characteristics did since the a member of staff of one’s All of us or some of the businesses). While you are notice-operating, you are in a position to deduct efforts in order to a sep, Effortless, or licensed retirement package that give retirement benefits on your own and you will your own popular-rules staff, if any.

None you nor your wife can be allege lower than any tax pact not to be a good You.S. resident. You ought to document a combined taxation return to your 12 months you create the choice, but you plus partner is also file mutual or independent production inside later years. Use the exact same processing condition for California which you used for your own government income tax return, unless you are an RDP. If you are an RDP and document direct out of house to own government aim, you could document lead away from house for California aim only when your qualify as experienced unmarried otherwise experienced maybe not in the a domestic relationship.

Either clients tend to demand to use the security deposit to fund the very last day’s lease, even when that isn’t judge in all claims. In case it is permissible beneath the law where your own leasing device is situated, that it however is generally an unwise choice for you as the a property owner. For example, when you have raised the book at some point within the tenancy, the security deposit doesn’t shelter a full number of lease if this is actually originally equal to one month’s rent.

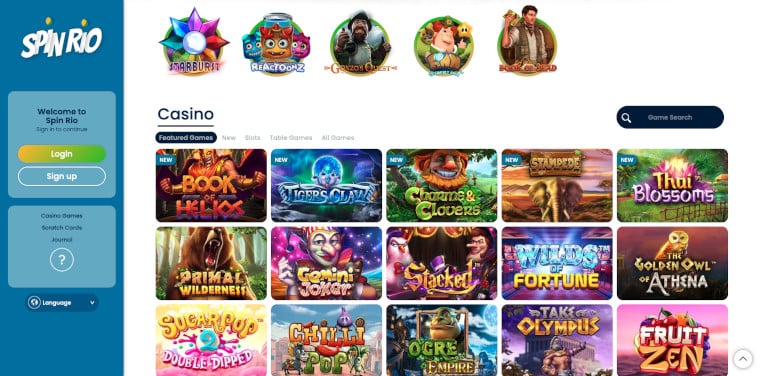

Including the newest issues that grounds to your “need to haves” including defense and you may fairness. Following that, we venture after that to your problems that become more out of an issue from preference for example promotions and different $5 gambling games to experience. Nevertheless, many of these something grounds for the our unique get system you to comes up as to what you will find good reason to trust are a knowledgeable possibilities available today, and now we want to share the top things that i research only. Less than, there are the initial criteria i review in terms to help you min deposit casinos online. If you’re unable to report some nonexempt money one to is more than a-quarter of your own nonexempt money found on the your return, an additional punishment of a-quarter of one’s taxation due on the the newest unreported income would be enforced. As well, an excellent taxpayer may well not document an amended come back tricky the newest department’s coverage, the translation or the constitutionality of one’s Commonwealth’s legislation.

Out of pizza pie beginning on the coming of your own Uber, the owners is track the fresh reputation away from nearly that which you. But once you are considering security put refunds, of several citizens be in the dark in the if the, where, and when their reimburse often appear. Uncertainty in regards to the position of the refund can lead to far more confusion, grievances, and calls. The good news is to flip so it to on the a positive and offer interest while the a resident economic amenity. Roost’s current functions survey discovered that more than 60% from people said making desire on their protection put tends to make him or her more likely to renew its book. For some renters, the safety put is short for most the internet value, and having those funds locked up, inaccessible, and never focusing on their part is going to be regarded as unjust.

To stop which have income tax withheld to your earnings gained on the Joined Says, bona-fide people of one’s You.S. Virgin Islands would be to create a letter, inside content, on the employers, saying that he could be bona-fide citizens of one’s You.S. If you think some of your issues led to effortlessly linked earnings, document the get back revealing you to definitely money and you may related write-offs by typical due date. Because the a twin-status alien, you could potentially generally allege taxation credit utilizing the same legislation you to affect resident aliens.

You simply can’t claim a cards for more than the amount of fool around with tax that is enforced on your own use of property inside the that it state. Including, for those who paid back $8.00 conversion taxation to another condition to own a purchase, and you will would have paid back $6.00 inside the Ca, you can allege a credit of merely $6.00 for this get. A young child under years 19 otherwise students less than decades twenty four could possibly get owe AMT in case your sum of extent on the web 19 (nonexempt earnings) and you will people preference points noted on Plan P (540) and you can provided on the return is more than the sum of $8,950 as well as the boy’s made income.